[Class 1] The Role of Payroll Department in an Organization - Payroll Management, Introduction of HRM, HR Planning for "Payroll Budget" , Compensation Management and Salary Administration, Employee Transfer and Promotions, Performance Appraisal and Increment Process.

[Class 2] Income Under The Head Salaries u/s 17(1) of Income Tax Act, 1961 - Meaning of Salary, Wages, Annuity and Retirement benefits, Allowances and type of Allowances , Valuation of Perquisites and Taxability of Perquisites , Retirement benefits.

[Class 3] Salary Components in terms of Fixed and Variable - Setup Payroll Administration and Functions, Structure of cost to company - CTC Annexure, Bonus Payment and Treatment of Bonus, Fee and Commission and Overtime Payment, Taxable and Non Taxable Payments (Exempted).

[Class 4] Claim and Reimbursement Management - Claim Management Module, Expense bills Submission, Medical Reimbursement and Travel Reimbursement, Type of Reimbursements, Disbursement of Claim Reimbursement.

[Class 5] Attendance Management System and Resignation (Full and Final) of Exits - Time Management System, Leave Management System, Type of leaves and Leave without pay Calculation, Full and Final Settlement Input and Calculation.

[Class 6] Employee Provided Fund - PF - What is a covered establishment?, Who will be covered by the Pension Scheme?, PF Wages, Contribution accounts and Rates, PF Deposit Date, KYC and UAN Sewa, PF Forms, ECR, Filling and Claim Settle.

[Class 7] Employee State Insurance - ESI - What is a covered establishment?, Existing Wage Limit, ESI Contribution rates and Contribution Periods, ESI cards, Deposit dates and compliance.

[Class 8] Professional Tax - PTAX (PT) - Professional tax applicability, Professional tax slab state wise, Professional tax calculator, Professional tax payment & registration.

[Class 9] Labor Welfare Fund - LWF - Labor welfare fund applicability, Labor welfare fund rate (slabs) state wise, Where to deposit Labor Welfare Fund.

[Class 10] Tax Deduction at Source - TDS - What is Income-tax?, Income Tax Slabs and Income tax Computation, Marginal tax and computation, Last Date of TDS deposit and quarterly return , Income tax Annual return and TDS Certificate (Form 16) , Interest on late payment.

[Class 11] Deduction (u/s 80C - u/s 80U) of Chapter VI-A of Income Tax Act, 1961 - Deductions under section 80C, Deductions under section 80D, 80E, 80U, Deductions under section 80DD, 80DDB, 80CCD2, Deductions under section 80G, 80GG, 80GGA, Deductions under section 80TTA etc.

[Class 12] Validation or Examination of Investment Proofs and Reimbursement Claims - Investment Proofs examination Under section 80C, Investment proofs examination others, Expense Bill examination of Reimbursements , Limit of Deductions and max eligibility up to Prorata , Previous Employer Income.

[Class 13] LTA, HRA, Leave Encashment and Gratuity Exemption Calculations - Leave Travel Exemption, House Rent allowance - HRA Exemption, Leave Encashment Exemption, Gratuity Exemption, Exemptions others.

[Class 14] Deduction of Entertainment Allowance and Professional Tax - Deduction of Entertainment Allowance , Entertainment Allowance is part of Tax Certificate, Deduction of Employer Tax (Professional Tax), Professional Tax is part of Tax Certificate, Other Income for Tax Deduction.

[Class 15] Deduction of Interest on Housing Loan u/s 24(b) of Income Tax Act, 1961 - Meaning of House Property, Essential conditions for taxing income under this head, Interest on borrowed capital, Standard deductions, Deductions from income from house Property [Sec.24], Calculation format and Examples.

[Class 16] Gather Payroll Inputs, Setup Employees Information in Payroll System - The Features of Payroll Processing, Employee Profile setup, Update Payroll Changes, Validation of Row data and Check Reference of Calculation flags.

[Class 17] Apply compliance rule & Tax Rates and Determine Calculation & Deductions - Calculation variance compliance, PF, ESI, P.TAX, LWF, TAX etc. , Tax Rate, Tax computation and One-time Tax on One-time Payment, Calculate Year to Date (YTD) of Payment and deduction, Deductions of Investment declared by Employee.

[Class 18] Verification and Payroll Checking Step by Step - Prepaying variance reports of Monthly Payroll Payout, Transformation of Payroll inputs, Attribution of head count and cost payout, Income Tax deduction and Variance of Income Tax deduction - TDS, To give maximum benefit to Employee on investment declaration, Ensure Calculation of variance compliance, PF, ESI, P.TAX, LWF etc.

[Class 19] Salary Register, Slips, Bank Transfer and Management Information System - MIS - Overview on salary Slip and Salary Register, Management Information Reports - MIS, Variance of Payroll and Cost Center Reports , Bank Transfer to the Employee, Cost to Company Reports, Payment released offline by Cheque.

[Class 20] Prepare Statutory Reports PF, ESI, PT, ESI and TDS Form 24, Form 16 etc. - PF Contribution Reports, ESI Contribution Reports, Deduction Reports of Professional tax and Labor welfare fund, Deduction Reports of Income Tax and Income Tax variance Sheet, Prepare Form 24Q - Quarterly salary TDS return , Prepare Form 16 & 12BA - TDS Certificate.

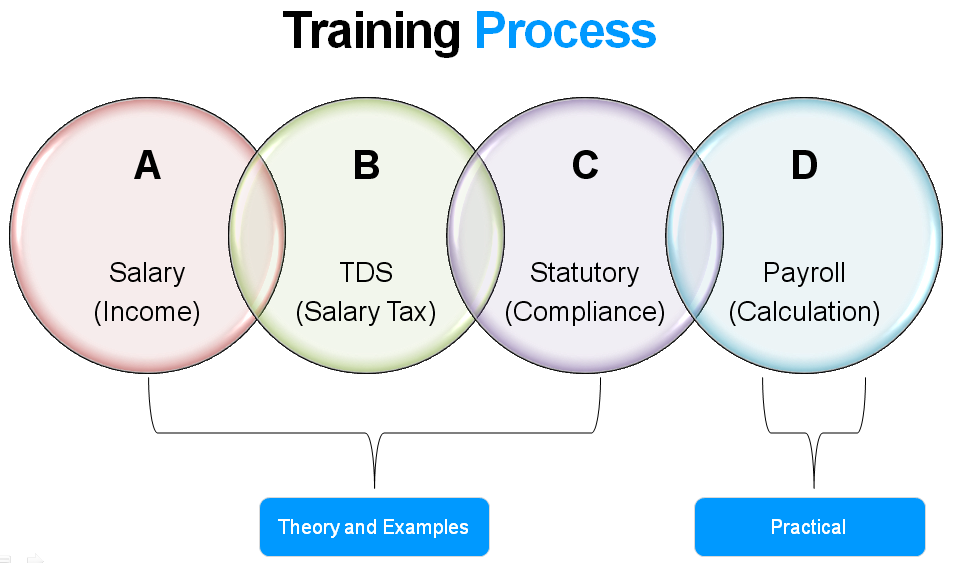

This course covers the most important part of income tax acts, 1961 of India and other related laws those are directly and indirectly related to an employees salary computation and saving. The main object of this course is to be complementing theoretical education by practical training in payroll field.

What you'll learn?

To enable the students to acquire sound technical skills in Payroll accountancy, provident fund and ESI schemes, Payroll auditing, Salary marking, income Tax deduction, save tax on Investment and educate to an organization people about tax deduction and saving schemes, financial management, corporate and lobar laws, direct and indirect taxation, Information Technology and related subjects and fields.

To train to provide theoretical education, practical training and computer training of the students undergoing payroll training course. Encouraging young talented students having aptitude for payroll accounting education to make an early entry to the profession.

--Creating employment in Payroll and Human resource department.

--To provide opportunities to work as payroll professional.

--Opportunity to acquire additional skill undergraduate and post graduate.

The training includes practical classes on daily basis (Home Work Practice).

Job seekers looking to find employment in Payroll and Human resource department. Employees those are working in Payroll Department and HR generally wanting to improve their skill set makes their Resume or CV stronger. Existing employees looking for better role can prove their employers the value of their skills through this certification.

Course Fee : Rs. 8,500/- (Includes all taxes)

Note: There are no additional fee for online student registration but student have to pay Rs. 295/- for online examination after completing training session.To go ahead, live your passions to the fullest with your HR Payroll Professional to get highest opportunities all over world. Take advantage of significant volume opportunities to maximize your skill when joining IPTM Payroll Training Course.

--Celebrate your payroll passion for the finer things in your departmentYes. Actually, registration in Payroll Course is available through online mode also. Registration through online services of institute is available at institute’s website https://www.iptm.org.in

Student shall be watch video from Tuesday to Friday and shall be join online or Attend face to face classes on weekend. But training time and days unchanged.

Therefore you have 5 options:-

Option 1. join the live class online. [Online]

Option 2. Attend the class offline face to face (at training center - 113, Ocean Plaza, Sector 18, Noida). [Classroom]

Option 3. Attend some classes offline Face to face and join rest of classes online from office or travelling time / home. [Online/Offline]

Option 4. Watch video of Saturday and join the live class online or offline on Sunday.

Option 5. Watch video Saturday and Sunday and do share homework (Practical) on email for verification. [Night Shift or Non Participant]

No. Student should pay whole amount in once to get all notes, course material, excel calculation sheets and daily videos from very first day.

Student can pay fee by Cash/Cheque/Online - debit card, credit card, netbanking & PAYTM.

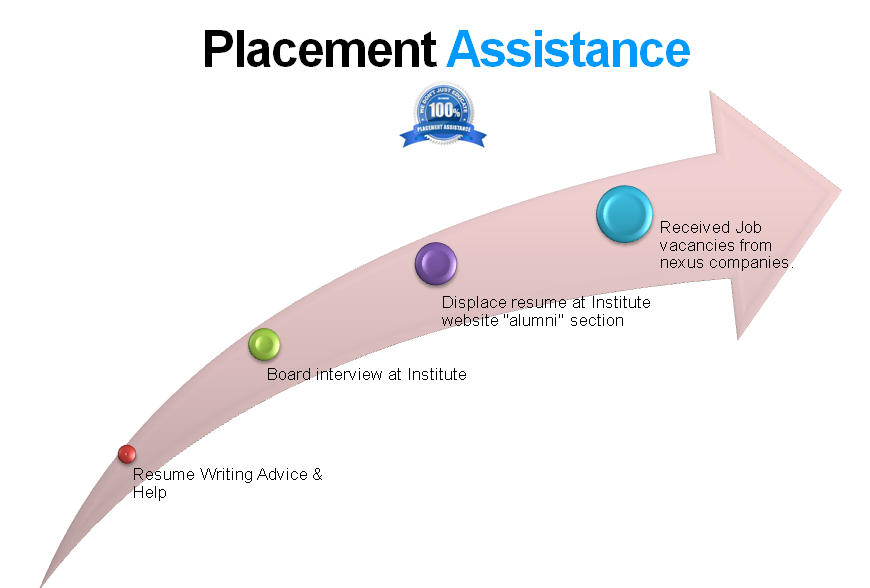

Payroll Professionals are in great demand. Companies specializing in Payroll Outhouse or human resource outsourcing are constantly hiring skilled Payroll professional.

IPTM have good source of payroll vacancies from over the PAN India and placed portal to upload your details on website to display on Internet.

You will be also connected in a good payroll network by WhatsApp group for latest updates.

Payroll training certification is a valuable, objective credential that verifies an individual's specified level of knowledge, skills, and abilities in the payroll profession.

Payroll Training certification is open throughout year and student shall attend 1 hour payroll online exam after training completion on following link.

Certification levels are: Marks>=60 Basic | Marks>=70 Advanced | Marks>=90 Excellent

(+91) 8766-243-879 ssd@iptm.org.in